Blog - Operational Technologies

How Simulation is Transforming the Insurance Industry

Process Simulation supports the decision-making steps around process changes to understand the intended, but also the unintended consequences. Simulation within the insurance industry also stimulates process exploration and visualisation, as, unlike the manufacturing or mining environment where bottlenecks are visibly apparent, most of the processes are “invisible” – or on a software system.

Process Simulation is a unique advantage that allows insurers to create risk-free environments that mimic real-world scenarios. Using SIMIO © software for process simulation, a virtual environment is created for ease of simulating different changes to a process base case developed using historical process data. The simulation can be run in a matter of minutes for extended periods in the future. With this level of process simulation, it is like looking into the proverbial crystal ball to predict the outcome of the intended change, and then select the best-fit solution for the business’s long-term goals.

4sight OT Simulation has partnered with a specific insurance company, over the past seven years to affect decision making before the implementation of process or system changes. The team has created just short of 100 models that affected decision making around contact centre human resource capacity utilisation, methods and timelines for working down excessive workloads during a catastrophic event (e.g. after floods or riots/looting), influencing different thinking patterns around intended changes, facilitating change management, which is aided by making the process and the changes visible to management and creating clarity around assumptions for new business cases. These are just a few examples of where process simulation has created value for the insurance company.

The team has also created simulation games to stimulate process thinking in a LEAN environment. A repository of small basic models was developed, in the pursuit of rapid simulation modelling, to highlight the fact that small process changes, like work-order prioritisation, could make a significant positive impact on daily operations.

Increased technical debt is incurred in the environments in the insurance company where decisions around complex system decisions are made based on gut feel or managerial input, without looking at the impact of the change holistically. Process Simulation has ensured that Insurance is delivered with optimal process value to enhance customer and employee experience.

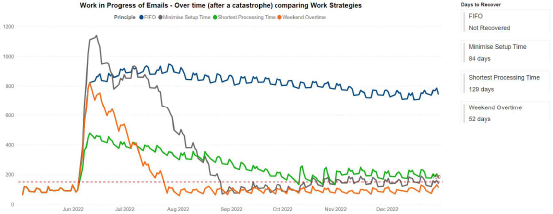

This is a line-graph showing the level of Work in Progress (WIP) emails in a Contact Centres inbox over time.

There was a catastrophic event (e.g., floods or riots) on 03 June 2022. The graph shows the number of emails that are currently in the inbox and compares different work strategies to one-another. The work strategies are First-In-First-Out (FIFO), minimizing the setup time between working on emails, prioritizing email which historically had the shortest processing time, and lastly allocating resources to work over-time over weekends. The work strategy is considered successful depending on if it could reach “acceptable” WIP levels again. (150 email – the red line). The visualisation on the right indicates which work strategy had recovered, if at all, and how many days it took to recover. As an example. The FIFO work strategies never recovered to acceptable WIP levels, and Prioritizing the email with the Shortest Processing Time First recovered in 129 day from the catastrophe date.

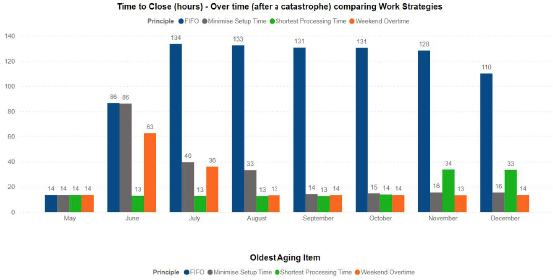

This bar-graph compares the maximum time it took to complete the processing a claim (after a catastrophe) over time by comparing the same 4 work strategies, as mentioned above, to one another. For example the FIFO work strategy caused that the longest claims took 134 hours to complete in July as compared to Weekend Overtime work strategy which took 36 hours to complete.

For assistance with process simulation in the insurance industry, contact the 4Sight OT Simulation team on This email address is being protected from spambots. You need JavaScript enabled to view it.